|

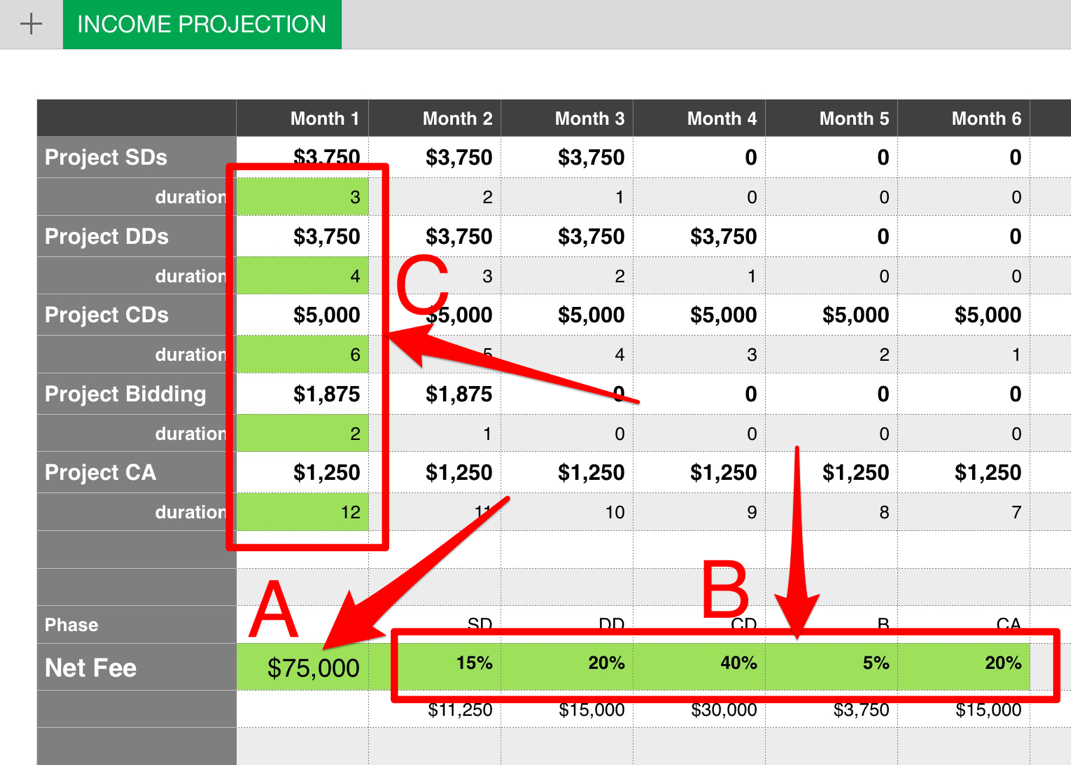

Whenever the economy tanks, I get really interested in cash flow. It's a habit that I try to hang onto when things are going well, too, because you can run out of money any time. But there is something about impending doom that gets your attention. Most of the guidance you can find on cash flow is geared to 'small businesses', less than 5,000 employees! This isn't very helpful. In a nutshell cash flow is predicting your cash-basis profit or loss. It is the nature of predictions to be wrong almost all the time. So a cash flow projection isn't reality, but you want to get close enough that there aren't any devastating surprises. This simple spreadsheet below is my attempt to get a view of the income side of the cash flow projection. The idea is to quickly allocate your fee for a project over time so you can compare it to the other ingredient - an expense projection. This spreadsheet looks at just one project. Copy it onto additional tabs, or copy the file for additional projects. By using the 'If' function, I have turned it into a template so that you have just three entries to make - fee, phase allocations, and durations. (Also check out OFFPLAN for putting it all together.) Here's how it works.

A] FEE Determine your 'net fee' and enter it here. The net fee does not include any part of the fee that will go to consultants. A number of things get more complicated if the consultants are included, so I choose to leave them out of both income and expenses. B] PHASE ALLOCATIONS The five standard phases and their standard percent of the total fee are the defaults. You may not have all the phases. In which case make that phase worth 0% and adjust the other percentages accordingly. If your fee is based on specific tasks instead of phases, rename the phases and overwrite the calculated phase fees in the row below the 'green phase percentages' with the amounts you have quoted for each task. C] DURATIONS The durations that I show for each phase are based on my experience with a project worth roughly $1,000,000. Change these durations to suit your project's anticipated schedule. Sometimes there will be two months worth of work, but the duration will be a month or two longer to allow for reviews, revisions, approvals and similar time factors. The duration in the first column is reduced by one as you move to the right. When the duration becomes zero, then through the IF function, the fee becomes zero, too. More columns can be added by copying the cells in the last column to the new columns. The end result is that I have taken the fee, broken it down into five phases, and then spread the fee for each phase equally over the number of months that I expect the phase to last. Customization of the results is needed several times. First when you are adding a project to your Cash Flow Projection (coming soon) you may have to adjust for how all your projects will be handled, and later almost every time you update your projection to accommodate what is really happening on the income and expense sides of your actual results. You will want to modify the template so that the defaults are more like your usual project. The Income Projection spreadsheet can be downloaded here in PDF format, xlsx format, and in Apple's Numbers format. This spreadsheet makes it dead simple to do a projection but the real benefit comes from being able to see the impact of all your projections at once and updated. There's a tool for a real cash flow projection. You can find it here. Comments are closed.

|

x

Archives

February 2024

Categories

All

|

Architekwiki | Architect's Resource | Greater Cincinnati

© 2012-2022 Architekwiki

© 2012-2022 Architekwiki