|

Fundamentals - How an Architectural Firm Works Architectural firms need to balance three major areas of activities to become sustainable. The three areas are: Design Services, Business Development, and Business Management. These three areas are usually not treated as equals but they could be. What you focus on will invariably set the tone for the type of firm that you build. Design Services encompasses all the results that we normally think of as practicing architecture - design concept, drawings, details, specifications, bidding and construction administration. This is a major part of your reputation because it is what people see and experience. Working on these items counts as billable time. Business Development consists of marketing and sales activities - nearly everything you do has a business development component to it - the look of your deliverables, the location of your office, your digital presence, even the type of projects that you design. These things are part of your reputation, also, but not as many people will experience this aspect of your firm. You need some level of success with business development activities in order to have an adequate and dependable flow of work. The time that you spend building a ‘brand’ is non-billable time, but very important in another way. Business Management contains everything else - policies, procedures, standards, risk management, office management, human resources, record keeping, software and digital systems, and financial management among others. These are all the things that keep your firm running smoothly. Like business development your time spent on business management activities is non-billable, but important. The billable work of the Design Services provides the money to not only pay for itself, but also to pay for the Business Development and Business Management activities. In other words, Design Services REVENUE equals Design Services COST plus Business Development COST plus Business Management COSTS … plus PROFIT. Financial Management of an architectural firm basically is determining how to get this simple equation to work - to get a positive value for Profit. Figuring this out, and achieving it, is what makes a firm sustainable. The first problem that you encounter when you set out to achieve this goal is that the simple equation conceals the relationship between time and money. And it turns out that the relationship between time and money is variable. Your solution to the equation will be unique. If you express the variable relationship, now the equation looks like this. Billable Time x Billing Rates equals (Non-Billable Time x Labor Rates) plus Project Costs plus BD Costs plus Office Costs plus Profit. For a one person firm you can insert your values in this equation and see how well your financial equation works. Is ‘Profit’ a positive or negative value? For more than one person, your equation becomes more of a spreadsheet that looks like this. Architekwiki offers this spreadsheet with instructions. See Financial Model Workbook. You can find more information about this topic here. As you evaluate your model you will notice that two issues are connected inexorably - efficiency and profitability. The more billable time that you have as a percentage of all your work time while at the same time decreasing every kind of expense, the more profitable you will be.

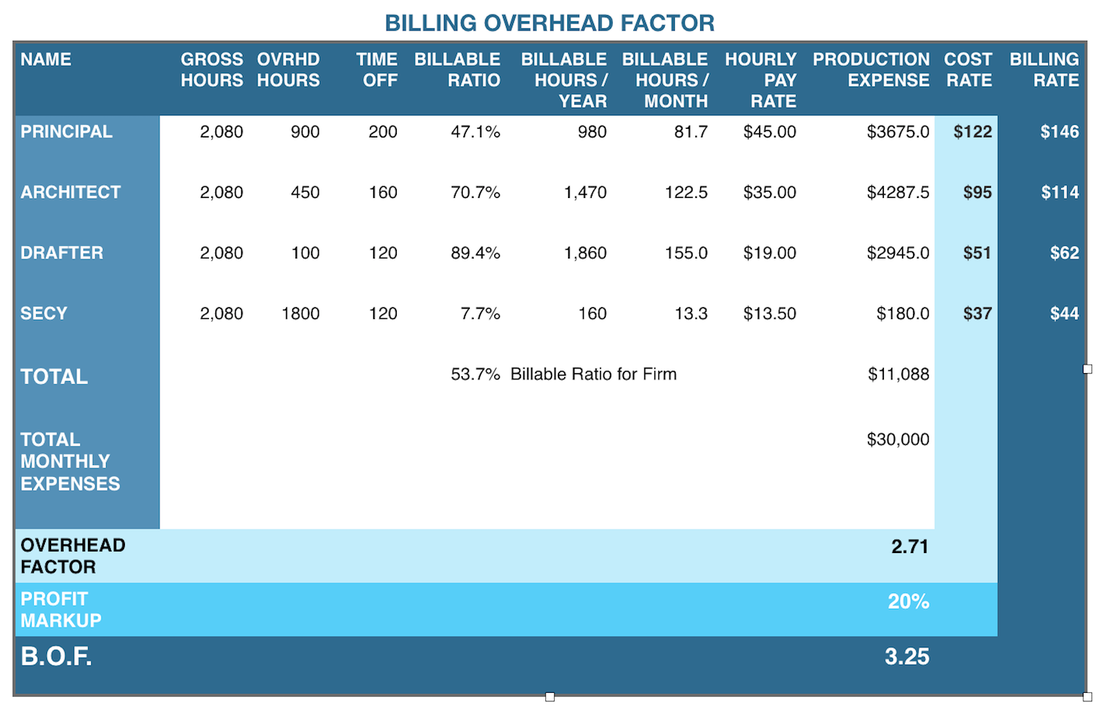

The spreadsheet works like this. List your staff. Contract workers are treated as consultants and not included. For each staff member enter the number of hours they are paid per year, the number of hours of paid time off they receive, the amount they are paid per hour and the percentage of their time when working that they are billable. This percentage is a guess at this point, which you will confirm over time. Any salaried staff should be converted to the equivalent labor rate wages. Look up your most recent tax return or financial report and determine what the total expenses where for a year including payroll, payroll expenses, and every other expense incurred to run your firm. Do not include consultants or reimbursable expenses. From your research calculate these values. Billable Time Cost: (total hours minus PTO) x labor rate. Determine this for each staff member and then add them together to get the total. The Overhead Multiplier, which is represented by total expenses divided by total Billable time cost. The Overhead multiplier is an interim step in determining the key Billing Rates multiplier. The Billing Rates Multiplier is represented by the Overhead Multiplier times one plus the profit markup that you wish to have. For instance if you want a 20% profit markup, you would multiply the Overhead multiplier by 1.20. The Billing Rate for each staff member, which is the Billing Rates multiplier times their Labor Rate. You have enough data now to do two things:

If the results are not what you want, there are just two things to focus on. First, evaluate your costs. Which of the costs are needed versus wanted? If shedding unnecessary costs are not enough to improve the results of your equation sufficiently, then try the second thing. The second thing is to review the assumptions about the percentage of billable time each person is contributing. Try different assumptions. Once you find the percentages that give you the results you want, you know what target each person needs to hit in order to actually get the desired results. You will invariably need to monitor these percentages of billable time to stay aligned with your equation. Ideally each person would monitor their own percentage because they are the ones who can change it. It is unfortunately the nature of things that change will make this analysis obsolete fairly quickly. Twice a year is a reasonable expectation for how frequently this should be reviewed. But fortunately it is easier and quicker each time. Comments are closed.

|

x

Archives

February 2024

Categories

All

|

Architekwiki | Architect's Resource | Greater Cincinnati

© 2012-2022 Architekwiki

© 2012-2022 Architekwiki