|

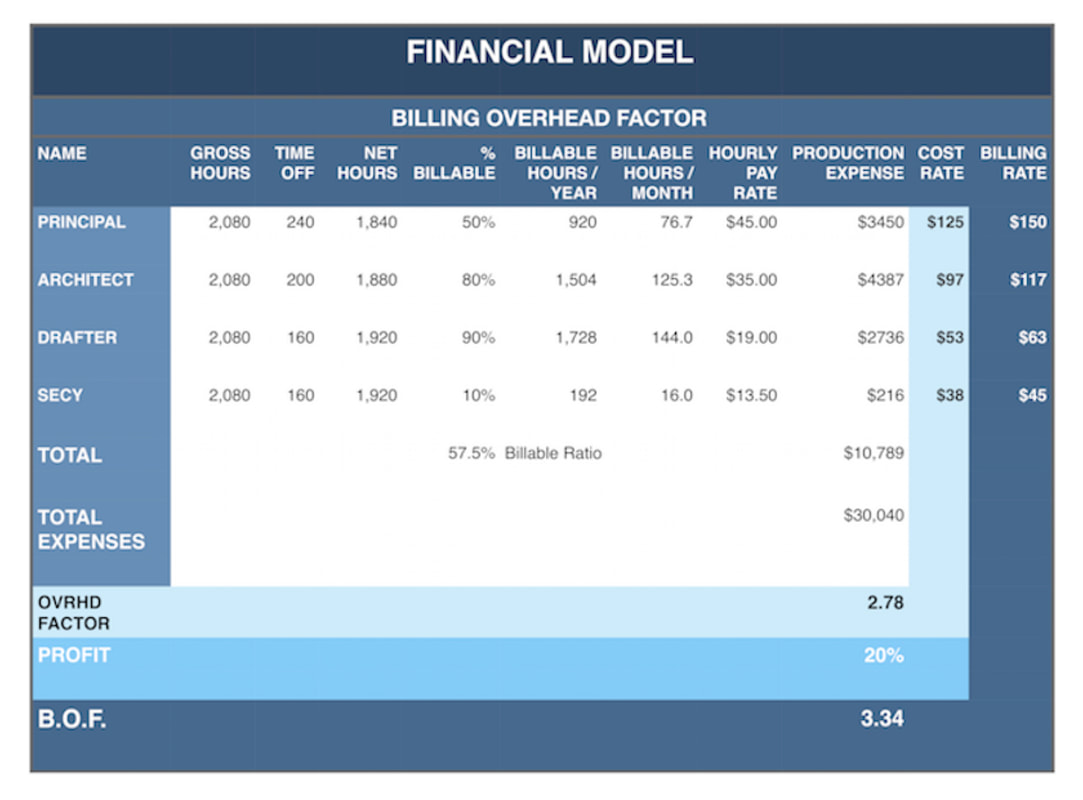

Architectural financial management has two components - bookkeeping and accounting. For managing the small firm, bookkeeping is the most important but usually takes a backseat to accounting. That is the opposite of what is needed. You can’t get useful feedback by delegating bookkeeping, but you can easily delegate accounting without a downside. Time and Money: you need to track both. Strangely time transactions are many times more frequent than money transactions. Based on 10 invoices per month plus another 20-30 money transactions, say 35 money transactions. But each person will have at least 2 time transactions per day, but it isn’t unusual to have 6-8 per day (so, 40 to 150 for the month - per person). The financial model for architectural firms is simple. The hours that you get paid for have to generate enough revenue to cover ALL the firm’s expenses plus a profit. So you must charge a multiple of your cost for those hours that you get paid for. That multiple is called the Billing Overhead Factor or BOF. [Cost of Productive Hours X BOF = Cost of All Operations + Profit]. To find your BOF, divide the Cost of All Operations + Profit by the Cost of Productive Hours. When you first build the financial model of your firm, it is normal not to know what you need to know. Especially the Cost of Productive Hours is tricky because you have to account for paid time off and the percent of the remaining time that is spent on work that you get paid for. You also are unlikely to have data on the percentage of each person’s time is billable. Your Cost of All Operations might be known from past experience or you might have to depend temporarily on the budgeted amounts for your Cost of All Operations. Profit is usually a target percentage unless you have studied what you need/want. Below is the spreadsheet that I have used. Profit - I recommend adding 20% or targeting 20%, or more. Add 20% in your BOF calculation, use 1.2 markup for Reimbursable Expenses. The Billable Ratio is usually a target unless you have data to work with. So it is trial and error to get a realistic number. Backlog can skew data a lot. Most efficient to guess after discussing it. Personally I have spent weeks of my life building expense budgets. That time was mostly wasted. “Just say no works better”. The act of planning is valuable but the results are not. Your business development efforts and effective project management will have a much greater impact than managing your overhead expense budget - just say no to new expenses. You get the Best Results by daily logging of time and money transactions. This requires just 5-15 min/day. There are two reasons that you get the Best Results this way. 1) GIGO - Garbage In, Garbage Out. 2) More importantly, you can have GREAT info at your fingertips all the time. It is priceless to know you are going over budget or drifting off target as early as possible so you can correct the problem. Comments are closed.

|

x

Archives

February 2024

Categories

All

|

Architekwiki | Architect's Resource | Greater Cincinnati

© 2012-2022 Architekwiki

© 2012-2022 Architekwiki