|

Three things are needed to be profitable. Of course I am referring to the time after you have secured a commission to design a project and also a reasonable fee to do the work.

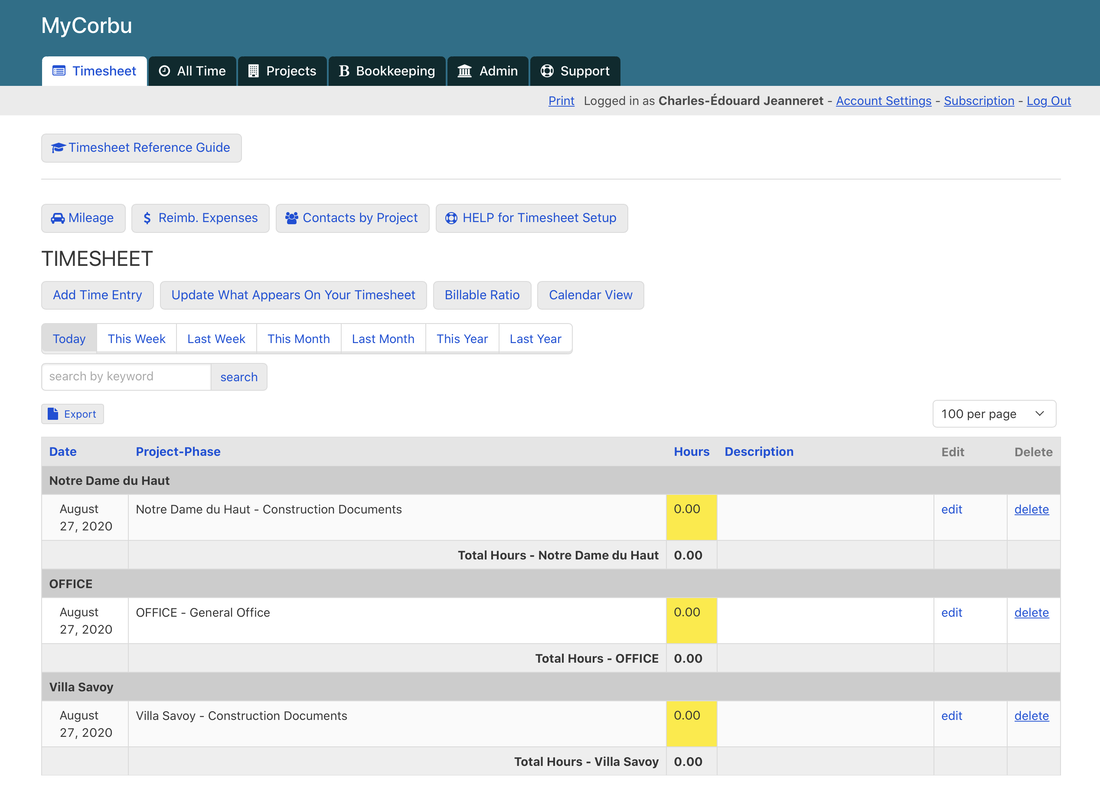

How often do you complete your timesheet?

I personally have used 'twice monthly', 'weekly', and 'daily' timesheets. You are probably different than me; but when I filled out my timesheet it usually went something like this ... A while back I posted an article about Additional Services. There are a lot of circumstances that arise where additional compensation for Additional Services is called for. In that first post I offered a simple way to get the issue on the table and approved. The second part of the issue is recognizing Additional Services.

Small firms don’t need accounting.

Your accountant doesn’t agree with me. He’s wrong unless your firm has over 20 members. The problem with accounting is that it requires brain-surgery-precision for a task that doesn’t much matter. When you stop to think about the time, effort, and aggravation that accounting requires; and what benefit you receive in return; something is fundamentally wrong. Basically you can’t afford to do accounting until you are large enough and complex enough to afford a bookkeeping employee. I know this because my six-person firm used accounting for most of our existence and got almost no benefit from the tens of thousands of dollars per year that we spent on accounting. Why did we do it? Ignorance. I thought I had to. I mistook AIA publications as applying to me. They don't. They apply to much larger firms than I ever had. About 93% of architectural firms are smaller than 20 people. They can't afford accounting. They can only afford bookkeeping. So what is the difference? For over 20 years I had the benefit of having Project Financial Status calculated for me by our (pricey) accounting software after each month was ‘posted’. You could choose from two methods. Method A was automatic but gave useless results. Method B required you to input an overhead factor to allocate overhead per hour of time charged to the project. This method gave consistent results and the results were accurate as long as your overhead factor was up to date.

You can see how to calculate an overhead factor here. MyCorbu provides the same Project Financial Status as a pricey accounting system. One difference is that MyCorbu does it daily rather than monthly. Most Architects can’t afford to do accounting

The reason is simple. Most architectural firms have less that 10 people. By most, I mean 80%. And architects can’t afford it because it takes at least 20 hours per week of someone’s time - on average. Just for accounting functions. I'm pretty ambivalent about employee reviews. From having done them, I know they are time-consuming if you are conscientious. I don't have any experience whatsoever in receiving a review. I know I am not like anyone else (we are all unique after all). Nevertheless I don't get it. If you don't give feedback daily/weekly, how does an annual/semi-annual review make up for it? If you do give feedback daily/weekly, what is an annual/semi-annual review for?

Big Picture Advice For SuccessI received the best advice of my career, two years after retiring.

That's when I finally got around to investigating the E-Myth. I was cleaning up old TO-DO lists, and got intrigued. What I learned is what 'working ON your firm' rather than 'working IN your firm' means in a practical sense. The Bottom Line: Develop your firm as though you plan to franchise it - even if you have no intention of doing that. If you don't make your firm into a 'franchise', then you and your firm are the same entity - and the firm only has value while you are part of it. If building a franchise is off-putting, you might think of the strategy as documenting your business knowledge, your methodology, your "How we do things around here". Besides the economic advantage of building a replicate-able business that you can eventually sell, there are three other main advantages. Reimbursable Expenses are like boomerangs.

They are supposed to return to you like a boomerang. Are your boomerangs returning larger, smaller, the same size, or not at all? Additional Services Documentation Made EasyA project without changes is unheard of. Clients change their minds. Budget problems surface. Contractors happen. A project without Additional Services is pretty rare. No one likes to talk about increases in fees. But which do you prefer? Losing money, but having a content client? Or getting paid fairly even if there is some discomfort involved? The first is not sustainable. The second is easier than you might think.

Here is my solution... As usual I am late to the party. For a couple of years I have heard about the E-Myth, but didn't think I needed to know about it. Well, I was wrong. Architects (everybody) need to know about this concept because if you are anything like me you will live or have lived it. (Near the end, below, I have some ideas about how individuals can use this concept.) BTW the first reason that I think Architectural Firms Are Small is here. I tend to collect pieces of information in Pocket or Evernote for perusal later, so I don't know exactly where I came across the book summary that I bought, downloaded and read about Michael E. Gerber’s 'E-Myth Revisited'. In a nutshell Michael E. Gerber describes how working IN your firm instead of ON your firm is a recipe for failure. But most importantly he describes what you SHOULD be doing. I know he is right because my firm could have been the poster child for his book. Did you know that census statistics indicate that most architectural firms are small. I have been wondering about that. Why would that be? Here’s the 2011 data that I found. All architectural offices = 21,181 offices 1-4 employees = 14,028 firms 5-9 employees = 3,711 firms Combined, that’s 17,739 of 21,181 firms - or 83.75%. I am a bit of a self-help junkie. Lord knows I need it. My first architect-boss informed me that I might make a better monk than an architect. I never listen.

During my self-help bingeing years, I probably consumed two dozen books that tried to tell me how to manage time. Very little of that wisdom stuck. The real help came from the authors who talked more about goals and priorities than time-management. Folks like Steven Covey, and Dan Sullivan of The Strategic Coach. But once you set goals for yourself, how do you actually get there? The best system I have found is 'The Three Things'. I don't know where it originates, but at least once a year I read an article that promotes the idea. As designers we aren't always comfortable on the site, observing what’s going on.

But there are good reasons to do it anyway. Profit planning wasn’t a concept I was familiar with. I distinctly remember our first profit and not knowing what to do with it. I didn't have a plan. I didn't even know I needed one. That’s probably one of the best problems to have. I don’t remember what I decided to do, but I know that was the start of many efforts to come to grips with profit planning in case the miracle happened again. I can’t claim to be an expert on the topic of ’Profit Planning’, but here are my thoughts.

Unique Methods is a concept that I learned from The Strategic Coach, Dan Sullivan. Everyone has processes that are unique to them. No two people go about design exactly the same, for instance. There are three main benefits to identifying your unique methods.

Taken together these three benefits add value to your firm by making your successes repeatable on every project. Whenever the economy tanks, I get really interested in cash flow. It's a habit that I try to hang onto when things are going well, too, because you can run out of money any time. But there is something about impending doom that gets your attention. Most of the guidance you can find on cash flow is geared to 'small businesses', less than 5,000 employees! This isn't very helpful. In a nutshell cash flow is predicting your cash-basis profit or loss. It is the nature of predictions to be wrong almost all the time. So a cash flow projection isn't reality, but you want to get close enough that there aren't any devastating surprises. This simple spreadsheet below is my attempt to get a view of the income side of the cash flow projection. The idea is to quickly allocate your fee for a project over time so you can compare it to the other ingredient - an expense projection. One of the major differences I found between designing projects in school and designing projects in a firm was the need to meet others' expectations. To me school design was like solving a puzzle. Having a solution was what mattered. Not how you got there.

When I was designing 'for real', I was never entirely on my own like in school. Getting all the drawing done in time for final printing was just one objective. The client needed to be kept in the loop. The consulting engineers needed drawing updates in time to complete their work. And they needed them far enough in advance for me to make sure their work was coordinated with everything else. Codes. Budgets. Specs. Having all these other expectations encouraged me to find a process. That's where Lessons Learned comes in. Should You Have Written AgreementsEveryone urges you to have written agreements for your design projects. There really isn't a good reason for not having a contract. However, we were rarely able to accomplish the goal of 100% of projects having a written agreement.

Our best effort to achieve this goal was to simplify the process. The two tools that we found helpful were a Letter Of Engagement, and our own Standard Agreement. There isn't anything wrong with standard AIA agreements. They aren't even hard or time-consuming to complete. But formality and exactitude get in the way. I should be a genius at delegation. I certainly put in the hours researching, planning, trying things out. I am mediocre at best.

This is a problem because business is dependent on delegation, and the architectural business is not any different. Now that I am retired, I am pretty much out of the business world, but I was thinking that many other architects face the same thing. My firm had in-house payroll for 30 years. I thought it was great. Pay period ends. The next day everyone had their paychecks by 11 AM.

Sweet. It wasn't until the last recession had us on the ropes, and, simultaneously, our accounting software provider wanted $12,000 for their new program that replaced the old program that they had decided to abandon that we challenged what we were doing. During my career we used a true accounting package designed for architects. You would think that everything worked great. You would be wrong. When it came to checking on the status of a project's budget, you rarely got an answer in the time frame that you were expecting.

Why wasn't a Project Status readily available?

The point is that getting a timely project status was a lot of work to keep up with. I am happy to report that bookkeeping solutions don't require all of that. Here's all you do... Maybe paying your bills is supposed to be painful. If you subscribe to that way of thinking, then by all means soldier on. If you don’t subscribe, but are using a process that involves a printer, I have good news.

The Internet is here to help you. First, let’s recap the old school process. This isn’t exactly what you are doing (because I don’t know anyone at NSA), but it is what I/we did for 25 years. It looks like this. Profit Planning From All Sides Profit planning wasn’t a concept I was familiar with. I distinctly remember our first profit and not knowing what to do with it. I didn't have a plan. I didn't even know I needed one. That’s probably one of the best problems to have. I don’t remember what I decided to do, but I know that was the start of many efforts to come to grips with profit planning in case the miracle happened again. I can’t claim to be an expert on the topic of ’Profit Planning’, but here are my thoughts. Profit is not a dirty word

Everyone loves what profits do. Profit provides bonuses, improvements of all types, and the ability to grow. Let me explain what I mean by profit. The simplest way to describe it is that profit is what you pay taxes on – actually it is what is left after you pay all your expenses. In the normal course of things, you won’t find out if you had a profit until March when your accountant finishes your tax return. Profit planning requires you to be more proactive than that. For instance you might want to pay a bonus before Christmas – the traditional bonus-giving time. We did. We could never get used to giving bonuses any other time than mid-December. So before Profit Planning took hold, we paid (modest) bonuses at Christmas based on feel and available cash. An ’informed’ decision would have been a ’different’ decision about the size of bonuses. Our third (or fourth) accountant offered to review our books in early December so we could be more accurate and better informed about profit planning. That’s actually a good idea, but we only took advantage of the offer (and paid the cost) when we were pretty sure there was profit that needed planning. If we thought we we going to have a loss, it wasn’t because we were trying to have a loss. Besides no amount of planning would turn things around in 30 days – we would have already done that if we could. So the first tactic for Profit Planning is predicting your profit for the year by getting your accountant to review your books and tell you where you stand. Depending on your bookkeeping system, this might be pretty easy. In any event you will be able to make a better decision about bonuses and other year-end issues. If you start this type of profit planning around Thanksgiving, there will be another month or so for which you will have to estimate your income and expenses. We always assumed that December would be a break-even (or worse) month because of time off around the holidays and clients getting distracted with the season’s festivities. I recommend that you take your accountant’s advice with a pinch of salt. There is a difference between accounting advice and business advice. You may have to filter your accountant’s advice by your feel for internal and external ramifications. There were plenty of recommendations I wasn’t willing to follow to save $200. You decide. You need to KNOW the numbers, but you may not want to LIVE by the numbers. We eventually had software that gave us a good feel for where our profit/loss stood. I never felt the need to get down to the decimal point with this type of projection – a few hundred dollars either way was good enough. So this is the second way to go if you have the in-house tool to make a decent year-end projection. I plan to include that functionality in MyCorbu eventually. The main reason to go through all this is to determine bonuses and other uses of profit. Our situation, which I think is similar for most firms, was that we created a tax liability if money remained in the firm past year-end. Get your accountant to explain how you will be impacted so you have a guide to go back to each year. Our goal was to use up all profit by year end so that there was very little tax due. An unfortunate consequence of using up all your profit is that you will very likely be short of cash for the first few months of the new year. We made every effort to avoid using our bank for a working capital loan. Often times I loaned my bonus back to the firm to avoid a bank loan. The key issue is that knowing the facts beforehand is much better than finding out the facts afterwards. Mark your calendar to start working on this in early November. Uses Of Profit So what is profit used for besides bonuses? This is the way that I think about it, and what we used profit for.

Profit Allocation So if you have decided on bonuses, a new plotter, and a marketing initiative, you have probably just decided on how to allocate your profit. In fact my experience is that trying to allocate profit by some formula never seems to work out. Instead, if you give some thought to what you would do with a profit of $xx,xxx, this always seems to ‘allocate’ the profit. It also gives you a target to shoot for. Consider turning the process around, and decide what you would like to do, and how much profit that will take. Put numbers on each item, add them up, and you have your profit target – or at least your first stab at a target. If you don’t go through this exercise, you don’t really have a way to determine what your hourly rates should be. If you aren’t charging enough to give bonuses, then you can’t give bonuses without going broke. (I described how to go about this in this post.) Profit gets factored into hourly rates, design budgets – make it conscious. Markup In Profit Planning To move beyond using an arbitrary percentage markup, plan how much profit you would like by budgeting amounts for your profit allocation. Here’s an example: |

x

Archives

February 2024

Categories

All

|

Architekwiki | Architect's Resource | Greater Cincinnati

© 2012-2022 Architekwiki

© 2012-2022 Architekwiki